In countries such as Australia that have comprehensive tobacco advertising bans, tobacco companies have shifted to trade promotion and business-to-business marketing strategies, as opposed to retail promotions directly targeted towards consumers. These strategies are carefully designed to comply with the law, however, still appear to be helping to drive sales, not just maintaining relationships with trade partners.

Trade promotion strategies include; financial and experiential incentives, such as price promotion and discounts, rebates, and cash payments, as well as parties, events, ‘once-in-a-lifetime’ experiences and vacations; Direct advertising to retailers through key trade and retail publications; Sponsorship, attendance and presentations at retail trade conferences; And retailer brand education.

Financial incentives:

A 2018 study 1 investigated tactics employed by tobacco companies in response to the ban on point-of-sale (POS) tobacco displays in Scotland. The study focused on the use of retailer incentives as a method to maintain product visibility and market share. The results demonstrated that after the implementation of the POS display ban, tobacco companies shifted their strategies to offer retailers various financial incentives. These incentives included monetary rewards, price promotions, and discounts on tobacco products, with the goal of encouraging retailers to maintain stock, promote sales, and provide preferential shelf space for particular brands. 1 Two Australian studies 2, 3 reported similar findings, with financial incentives including price promotion and discounts, volume-based rebates, and cash payments to retailers.

Experiential incentives:

Experiential incentives provided by the tobacco industry to retailers such as parties, events, ‘once-in-a-lifetime’ experiences and vacations are used for the purpose of marketing, building relationships and creating hype. 3

Included in a 2015 Australian Retail Tobacconist magazine was a reflective piece on the success of British American Tobacco Australia’s (BATA) retailer vacation held at the InterContinental Fiji Golf Resort & Spa. 4 According to the article, sixty Australian tobacconists attended the seminar where BATA held intimate discussion sessions with the tobacconists, who were encouraged to vent their issues and suggest ideas in a Q&A session. Motivational speakers, and bonding and learning sessions were also held. BATA’s reported focus for the seminar was to ‘reposition their relationship with the tobacconists and encourage a more transparent and trustworthy way of doing business’, as well as ‘gain[ing] a great deal of intel as ideas and suggestions and problems were discussed’. 4

Former tobacco industry employees in a 2020 Australian qualitative study 3 also describe how top performing retailers are taken on all-expenses paid vacations, including ‘Hawaii, to the Top End of Australia, to Monaco for the Formula One Grand Prix and to the Rugby and Soccer World Cups’. As well as, ‘Japan, to Formula One Grand Prix events in Melbourne and outside Australia, and to Alaska and Canada for ‘once-in-a-lifetime experiences’, such as paddle boarding among glaciers’. Smaller scale experiential incentives reported by informants from the 2020 study include tickets to sports games, music festivals and ‘‘exotic car days’ where retailers were invited to drive a Lamborghini, Ferrari, or Mercedes’. 3

Advertising directly to retailers:

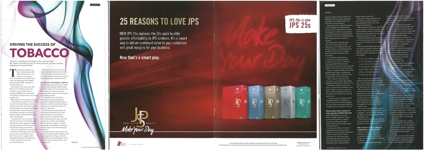

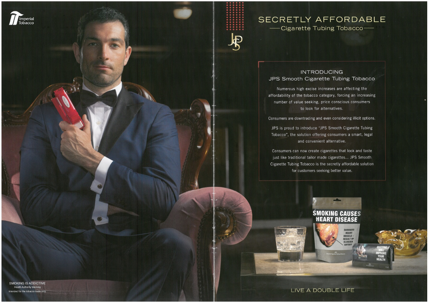

The tobacco industry frequently promotes new products, or updates to existing products, through advertisements in key trade and retail publications. In the June 2019 Australian issue of Convenience World, a four-page advertisement for Imperial Tobacco was featured (see Figure 11.8.1 below). 5 This advertisement appeared in the coveted centrefold position, flanked by two pages of text designed to resemble a magazine article, titled 'Driving the Success of Tobacco'. The Australian Retail Tobacconist magazine also includes frequent trade specific advertisements from the tobacco industry encouraging retailers to stock and sell their products. For example, in Figure 11.8.2 below, part of the caption reads ‘…Consumers are downgrading and even considering illicit options. JPS is proud to introduce “JPS Smooth Cigarette Tubing Tobacco”, the solution offering consumers a smart, legal and convenient alternative…’. 6 Other advertising targeted toward retail staff has included instore promotional materials, such as branded computer mouse mats and desk calendars. 3 As well as advertisements strategically placed out of consumer sight, for example, on computers, on cash registers, and on the inside door of display cabinets, as reminders to staff to promote certain tobacco brands and products. 3

Figure 11.8.1 A four-page ad by Imperial Tobacco, appearing in the Australian trade magazine ‘Convenience World’.

Source: Convenience World, Issue No.3, Volume 17, June 2019, p.27.

Figure 11.8.2 A double-page ad by Imperial Tobacco, appearing in the ‘Australian Retail Tobacconist’ trade magazine.

Source: Australian Retail Tobacconist, Volume 90 January-February-March 2014, p.4&5.

Trade conferences:

The tobacco industry also sponsors, and industry employees attend and present at retail trade conferences and meetings. For example, delegates at the 2010 Australian Liquor Stores Association conference heard a representative from British American Tobacco Australia, discuss ‘potential opportunities for profit within the category while complying with the new [display ban] regulations’. 7 The Australian Association of Convenience Stores (AACS), the key trade body for more than 7000 petrol and convenience stores in Australia, has been the recipient of funding from all three major transnational tobacco companies in the Australian market—Philip Morris International (PMI), British American Tobacco Australia (BATA) and Imperial Brands (Imperial). 8 Internal documents show BAT co-sponsored its annual AACS Convention trade shows throughout the early and mid-2000s. 8 In a qualitative study interviewing former Australian tobacco industry employees, an undisclosed tobacco company was said to have sponsored the Independent Grocers Association (IGA) conference for store franchisees for the purpose of ‘wining and dining’ the franchisees. 3

Retailer education:

Retail staff serve as a crucial channel for the tobacco industry to engage with customers. Tobacco industry sales representatives invest time in educating retail staff to ensure the prominence of specific brands and new products in customer interactions. This brand education is facilitated by tobacco industry sales representatives through face-to-face encounters, during events, meetings, and with the help of promotional materials. Retailers frequently receive incentives to participate in learning and training sessions. Retailer education also includes consumer behaviour information provided by the tobacco industry to support retailers in product sales. 3

Policy response:

Researchers have highlighted the need for enhanced regulatory control over tobacco industry practices to support public health policies aimed at reducing tobacco consumption and associated harms. The above trade promotion strategies contribute to the ongoing availability and importance of tobacco products in retail environments, undermining tobacco control policies by increasing the likelihood of retailers continuing to sell tobacco products, stocking and listing certain brands on price boards, 9 and positively promoting particular products in conversations with customers. Stricter regulations on tobacco marketing aimed at retailers has been called for by researchers, along with comprehensive strategies addressing retailers' roles and tobacco companies' influence in driving tobacco sales. 1-3

Relevant news and research

A comprehensive compilation of news items and research published on this topic

Read more on this topic

References

1. Stead M, Eadie D, Purves RI, Moodie C, and Haw S. Tobacco companies’ use of retailer incentives after a ban on point-of-sale tobacco displays in Scotland. Tobacco Control, 2018; 27(4):414-9. Available from: https://tobaccocontrol.bmj.com/content/tobaccocontrol/27/4/414.full.pdf

2. Watts C, Burton S, Freeman B, Phillips F, Kennington K, et al. ‘Friends with benefits’: How tobacco companies influence sales through the provision of incentives and benefits to retailers. Tobacco Control, 2020; 29(e1):e119-e23. Available from: https://tobaccocontrol.bmj.com/content/tobaccocontrol/29/e1/e119.full.pdf

3. Watts C, Burton S, and Freeman B. 'The last line of marketing': Covert tobacco marketing tactics as revealed by former tobacco industry employees. Glob Public Health, 2020:1-14. Available from: https://www.ncbi.nlm.nih.gov/pubmed/32946326

4. Australian Retail Tobacconist, Volume 94, April-May-June 2015, p.7.

5. Convenience World, 2019, Issue No. 3, Volume. 17.

6. Australian Retail Tobacconist, Volume 90, January-February-March 2014, p.4-5.

7. Looker A. BATA lights up ALSA conference. The Shout, 2010. Last update: Viewed Available from: https://theshout.com.au/bata-lights-up-alsa-conference-video/.

8. No author listed. Australian Association of Convenience Stores. Tobacco Tactics, 2022. Available from: https://tobaccotactics.org/article/australian-association-of-convenience-stores/

9. Bayly M, Scollo M, White S, Lindorff K, and Wakefield M. Tobacco price boards as a promotional strategy—a longitudinal observational study in Australian retailers. Tobacco Control, 2018; 27(4):427-33. Available from: http://tobaccocontrol.bmj.com/content/tobaccocontrol/27/4/427.full.pdf