18C.1.1 Types and brands of oral nicotine products

A new category of non-therapeutic oral nicotine products has emerged in recent years.’. Distinct from nicotine replacement therapy (NRT) used for smoking cessation (see Section 7.16), these products feature sleek and stylish designs, are available in a wide range of sweet and fruit flavours, and are marketed as non-therapeutic nicotine products (see Section 18C.2). It is not legal to supply or market these products in Australia 1 —see Section 18C.7.

Oral nicotine pouches

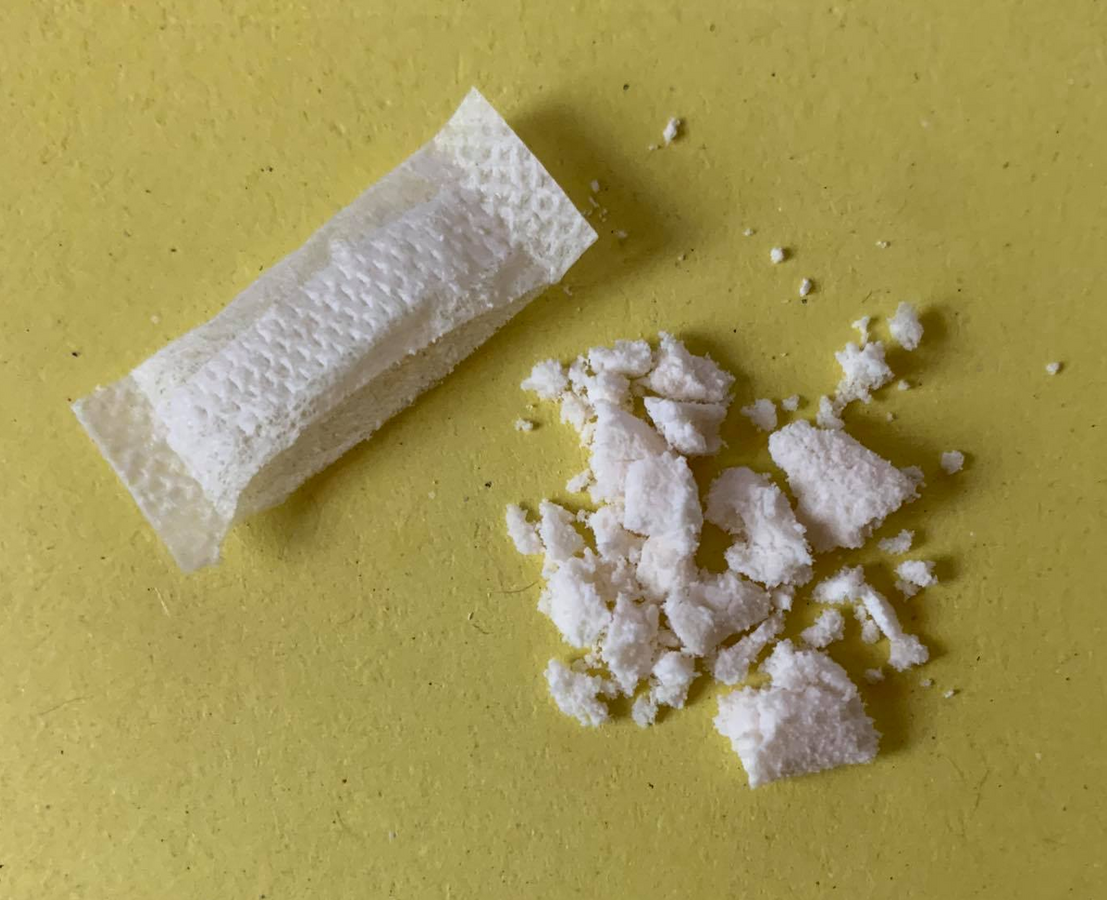

Like snus (see Section 12.2.9), oral nicotine pouches are sold as pre-portioned pouches that are placed between a person’s lip and gum for oral nicotine absorption—see Figure 18C.1.1. Unlike snus however, the products contain no tobacco leaf, and are instead filled with white powder containing nicotine (tobacco-derived or synthetic), flavourings (e.g., fruit, mint, coffee), and other constituents such as stabilisers, fillers, pH adjusters, and sweeteners (see Section 18C.4.4). 2-4

Figure 18C.1.1 Nicotine pouch contents

Many of the major tobacco companies have started selling oral nicotine pouch products in varying flavours and strengths, both through developing their own products and through recent acquisitions of nicotine pouch brands. 2, 5, 6

Non-therapeutic nicotine gum

Unlike therapeutic NRT gum that is manufactured by pharmaceutical companies and available at subsidised cost on the Pharmaceutical Benefits Scheme (PBS) for smoking cessation (see Section 7.16.1), non-therapeutic nicotine gum is packaged in sleek designs that resemble regular chewing gum. There are a wider range of flavours including fruit, mint and coffee. The labels do not indicate that it is for therapeutic use, and it tends to be cheaper than NRT gum. 7

Other non-therapeutic oral nicotine products

A range of other non-therapeutic oral nicotine products have entered the market, including lozenges, tablets, discs, gummies (chewy lollies), and toothpicks. Like NRT gum, therapeutic nicotine lozenges are also available on the PBS in Australia (see Section 7.16.1), while non-therapeutic nicotine lozenges are flavoured, lolly-sized products which are designed to slowly dissolve in the mouth and are packaged in small, colourful plastic containers. Non-therapeutic nicotine tablets are similar but are designed to rapidly dissolve. Nicotine discs are chewable tablets that are discarded after use, similar to chewing gum. 8 Nicotine gummies are marketed as ‘a sweet alternative for adults’ and described as ‘supplements’ on packaging in the US. Each of these products is widely available across the US. 9

18C.1.2 International sales of oral nicotine pouches

Nicotine pouches were first introduced in Europe but are now available in other countries such as Indonesia, Kenya, Pakistan and the US. 10 The global nicotine pouches market size was valued at USD 1.99 billion in 2022 and is predicted to grow at a compound annual growth rate of 35.7% to reach USD 22.98 billion by 2030. 11 The US and Sweden are reportedly the largest markets, possibly due to their higher use of smokeless tobacco products. 4 In 2022, 75% of sales of oral nicotine pouches recorded by Euromonitor were in the US, 11% in Sweden, 4% in Denmark and 2% in Pakistan. 5 PMI’s purchase of Swedish Match in 2022 gave it substantial dominance in the global market with a 60% share, from less than 1% in 2021. BAT and Altria followed, with 16% and 8.5% shares respectively. 5

An analysis of sales data in the US showed that sales of oral nicotine pouches increased substantially from 163,178 units (i.e., containers of typically 15–20 pouches) in 2016 to 45.97 million units in January–June 2020. Mint was the most popular flavour across the study period, while fruit flavours showed the most rapid increase. Convenience stores accounted for 97.7% of total sales. 6 A more recent study similarly found a sharp increase in US sales over the past few years, from 126.06 million units (defined as a single pouch) in the period August–December 2019 to 808.14 million units from January to March 2022. The most common nicotine concentration levels sold were 6 mg, 4 mg, and 3 mg; however, sales of 8 mg products increased more rapidly over time. 12

Relevant news and research

A comprehensive compilation of news items and research published on this topic (Last updated April 2025)

Read more on this topic

References

1. Therapeutic Goods Administration. Nicotine pouches. Australian Government Department of Health and Aged Care, 2024. Available from: https://www.tga.gov.au/products/unapproved-therapeutic-goods/vaping-hub/nicotine-pouches

2. Robichaud MO, Seidenberg AB, and Byron MJ. Tobacco companies introduce 'tobacco-free' nicotine pouches. Tobacco Control, 2020; 29(e1):e145-e6. Available from: https://www.ncbi.nlm.nih.gov/pubmed/31753961

3. Vogel EA, Tackett AP, Unger JB, Gonzalez MJ, Peraza N, et al. Effects of flavour and modified risk claims on nicotine pouch perceptions and use intentions among young adults who use inhalable nicotine and tobacco products: a randomised controlled trial. Tobacco Control, 2023. Available from: https://www.ncbi.nlm.nih.gov/pubmed/38148143

4. Sparrock LS, Phan L, Chen-Sankey J, Hacker K, Ajith A, et al. Nicotine Pouch: Awareness, Beliefs, Use, and Susceptibility among Current Tobacco Users in the United States, 2021. International Journal of Environmental Research and Public Health, 2023; 20(3). Available from: https://www.ncbi.nlm.nih.gov/pubmed/36767414

5. Tobacco Tactics. Nicotine Pouches. 2023. Available from: https://tobaccotactics.org/article/nicotine-pouches/

6. Marynak KL, Wang X, Borowiecki M, Kim Y, Tynan MA, et al. Nicotine Pouch Unit Sales in the US, 2016-2020. Journal of the American Medical Association, 2021; 326(6):566-8. Available from: https://www.ncbi.nlm.nih.gov/pubmed/34374729

7. Callard C. Sesh+: Another nicotine product hits convenience store shelves. Physicians for a Smoke-Free Canada, 2023. Available from: https://gem.godaddy.com/p/240f261

8. US Food & Drug Administration. FDA Permits Marketing of New Oral Tobacco Products through Premarket Tobacco Product Application Pathway. 2021. Available from: https://www.fda.gov/news-events/press-announcements/fda-permits-marketing-new-oral-tobacco-products-through-premarket-tobacco-product-application.

9. Borowiecki M, Emery SL, and Kostygina G. New recreational nicotine lozenges, tablets, gummies and gum proliferate on the US market. Tobacco Control, 2022. Available from: https://www.ncbi.nlm.nih.gov/pubmed/36319083

10. WHO study group on tobacco product regulation. Report on the scientific basis of tobacco product regulation: ninth report of a WHO study group. WHO Technical Report Series, No. 1047., Licence: CC BY-NC-SA 3.0 IGO.Geneva: World Health Organization, 2023. Available from: https://www.who.int/publications/i/item/9789240079410

11. Grand View Research. Nicotine Pouches Market Size, Share & Trend Analysis Report By Product (Tobacco-derived, Synthetic), By Flavor (Original/Unflavored, Flavored), By Strength, By Price Range, By Region, And Segment Forecasts, 2023 - 2030. 2023. Available from: https://www.grandviewresearch.com/industry-analysis/nicotine-pouches-market-report

12. Majmundar A, Okitondo C, Xue A, Asare S, Bandi P, et al. Nicotine Pouch Sales Trends in the US by Volume and Nicotine Concentration Levels From 2019 to 2022. JAMA Netw Open, 2022; 5(11):e2242235. Available from: https://www.ncbi.nlm.nih.gov/pubmed/36378312